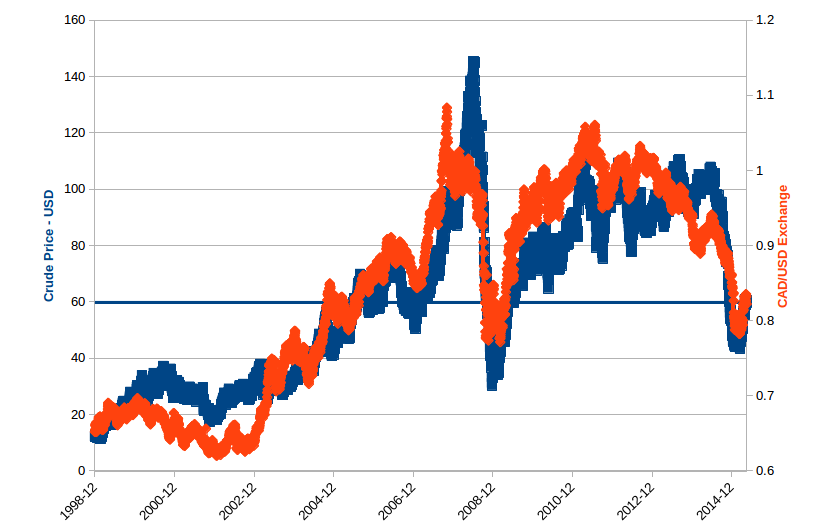

Playing around on the internet at lunch today, I came across a couple of interesting databases that confirm, at least visually, that we are a petro-economy. With data on the daily price of West Texas crude from the Federal Reserve Bank of St. Louis (thanks Google!) and daily foreign exchange closing data the following graph shows graphically just how linked the Canadian dollar value is to the price of crude oil.

I haven’t the statistics background to tell you *how* linked they are, but the picture is stark and convincing.

If, and this is a big “if”, the value of our currency is a reflection of the attitudes of investors on the strength of the Canadian economy, what they see in us is pretty apparent. Note that this graph goes back to the start of 1999, the earliest I could find currency data for, and the trend pre-dates the Conservative government, upon whom I blame all things bad. This one has not been helped by them, but it was not caused by them. I fully expect that pushing both of these databases further into the past would reveal a similar pattern for at least a generation or os.

It’s easy to draw up a couple of curves for unrelated things and claim some sort of linkage between them where none exists – follow this link to see some fun ones. I would argue that these curves are in fact related because they are normalized using the US dollar. This is a useful measure, as all formal trading in international oil bourses has used the US dollar as the price by which oil is set since the early seventies.

What does this graph mean?

First, if we really are a petro-economy, we had best keep finding and exporting oil if we want our dollar to be worth anything. Oil and gas are not going to last forever, though, and nor should they. The tar sands represent the last gasp of the Alberta oil industry, and while it could last for many years, it is still finite. East coast gas has proven to be a disappointment, at least while the peasants are still allowed to get their asses up about fracking. (C-51 may well settle that issue by making anyone protesting the destruction of their watertables for short-term profit a ‘terrorist’. We shall wait and see.) Atlantic oil flows from the Grand Banks, and there is every chance of other discoveries up the margin along the Labrador shelf and Baffin Bay, but development in these areas is still in its infancy. And Arctic resources are likely to be harder and therefore more expensive to access, making them less economically advantageous. Hopefully, before they become an issue we will be moving away from oil as our central fuel source.

The recent crash in the Canadian dollar and the simultaneous precipitous drop in the price of oil also has to do with our little normalizing factor up there, the value of the US dollar. The US economy has been booming along the last couple of years as they distance themselves from the depths of the 2008-09 recession. Job growth is up, exports are up, and they have quietly become the world’s largest producer of oil. For now, this spike in production south of the border has not been offset by cutbacks in OPEC production, and the price has been allowed to fall. How long this will go on is anyone’s guess and I’m not going to venture one.

Historically, Canada has been a resource-sector economy – we don’t really make much, instead we produce raw materials that are turned into goods by others, which we then buy from them. There is no shame in that, and the scenario works well provided the supply of raw materials is not exhausted. We are a fishing economy, a lumber economy, a farming economy, an oil economy, and a mining giant. There is no reason to think that these will all disappear after the oil goes. Whatever happens, resource exports will always be important.

However, as this graph and our fluttering economic growth show, when we become too dependent on one thing, we put ourselves at risk. And, this is where I can place some blame on the Conservative government. Instead of trying to promote industrial growth and manufacturing, the government sat on its hands while the high value of the dollar murdered our exporters. If we are to prosper as a nation, we need wise and courageous leadership to help foster blended economic growth. As I’ve said, resources will always be important, but there is no reason we can’t make stuff, too.

Hmmm … you can’t take the cause and make it the effect and I don’t know why you don’t think we ‘don’t really make much’. We USED to make LOTS until the oil economy killed our manufacturing sector.

In fact, through the 20th century, manufacturing was the backbone of this country, with the resource sector at the margins.

You come to the right conclusion though: under the Harper Conservatives we’ve returned to being a ‘putz’ of an economy, with global resource companies manipulating us into believing that ‘rocks, logs, wheat and hogs’ are what we should be all about.

LikeLike

I was a bit fast and loose with language, Liam, thanks for catching me. Manufacturing looks to have peaked at about 30% of GDP during the WW2, however it declined since and has been well under 20% since basically the recession in the early eighties. Check out (http://worthwhile.typepad.com/worthwhile_canadian_initi/2012/05/the-decline-of-manufacturing-in-canada-1926-2011-dutch-disease.html) in which the writer attempts to collate a couple of databases outlining 20th century manufacturing history in Canada.

LikeLike